Friends, we previously talked about Monday’s news that the Drug Enforcement Administration has scheduled for December a public hearing on cannabis rescheduling, after the November presidential election. You may have noticed that the stock market didn’t take too kindly to that news. It’s not much of an understatement to say that cannabis stocks got hammered by investors.

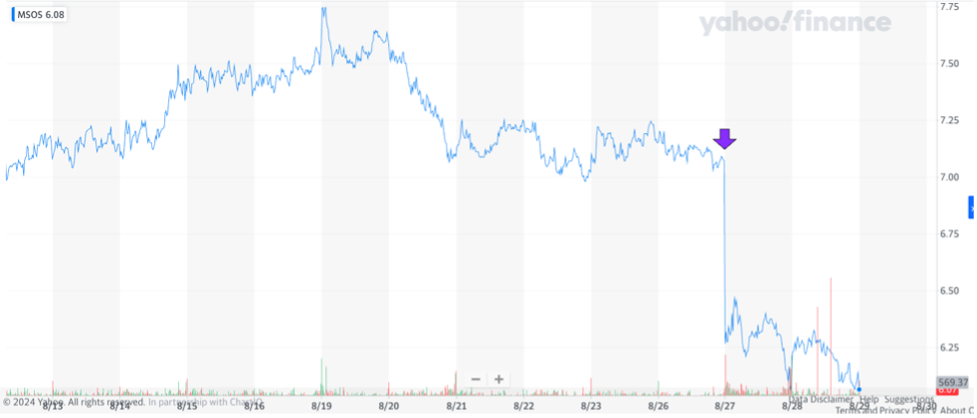

Exhibit A, the stock price of AdvisorShares Pure US Cannabis ETF (MSOS), an exchange-traded fund made up of US cannabis stocks:

It’s frankly a little mystifying to me why stock prices traded down so sharply. I suppose there’s now the theoretical risk that a second Trump administration scuttles rescheduling. Or maybe traders are adjusting their expectations of the net present values of public MSOs’ future cash flows, now that companies won’t get 280E relief until next tax year. But still, it’s not like the DEA rejected rescheduling entirely.

On the other hand, consider what happened to cannabis stock prices when the news of rescheduling first came out on April 30th of this year:

Prices skyrocketed, as one would have expected on such excellent news, but then quickly dropped back down to their pre-news levels. Weird, huh? There wasn’t good reason for that to happen. Sure, over time, as the process moseyed along, because nothing happens quickly in cannabis, one would have expected traders to get nervous about timing and likelihood, but I didn’t expect that to happen the very next trading day.

What’s also interesting to me is that it seems like 280E relief wasn’t priced into the market before Monday’s news. If stock prices had remained elevated after that May 1st surge, that would have suggested that traders were crediting public MSOs with the future value of the 280E tax relief that would come from rescheduling. However, as you can see from the chart, prior to Monday, prices were at their pre-April 30th levels, as if rescheduling (and the economic benefit from that tax relief) weren’t even in play.

So, if cannabis stock prices weren’t (apparently) pricing in rescheduling, why then did they drop so dramatically on Monday’s news that the process was slowly running its course? Darned if I know. Totally irrational economic behavior on the part of traders is another great example of why it’s so hard to be a publicly-traded cannabis company. Cannabis stock investors have been a highly-speculative and capricious bunch since companies first started going public on the Canadian Securities Exchange in the late 2010’s. Meshuggeneh ganz, meshuggeneh grieben. (“Crazy geese, crazy cracklings.”)

Remember when Tilray’s stock hit US$300 (that’s not a typo – three hundred US dollars!) per share intraday in September 2018? I do. Those were heady days. Cannabis stock prices have always been incredibly volatile due to a combination of factors, including (and this list isn’t exhaustive) low trading volume/liquidity, small float (many shares are still held by founders/insiders and don’t trade), second-tier exchange listings with lowered reporting requirements, overhyped and undersatisfied expectations, highly-underwhelming performance, a dearth of quality coverage and information, unsophisticated management, regulatory opacity, and the excitement of a new industry.

As a result, cannabis stock prices have rarely reflected the true value of the underlying issuers, at least based on more traditional ways of looking at company valuation. Prices have either been too high or too low. In other words, price discovery in cannabis stocks is fundamentally broken, leaving them much more vulnerable to sheer speculation.

Layer on top of that an unhealthy focus on the part of cannabis investors on potential catalysts that, in my opinion, really won’t move the needle, and, as readers of these Cannabis Musings know, I don’t think will happen anyway – SAFE(R) Banking, the so-called Garland Memo to replace the Cole Memo, the Canna Provisions case. The 280E tax relief that would come from rescheduling will have a much more immediate and profound economic effect on most companies in the industry than would access to checking accounts (which most companies have anyway). The existential threat of so-called “intoxicating hemp” is already hurting the licensed (non-hemp) cannabis industry and will continue to deteriorate market share unless the hemp loophole is closed by Congress in the 2024 (2025?) Farm Bill. Cannabis stock investors tend to focus on the wrong things, and then overreact to the tiniest kreplach of news about them.

The takeaway here is that cannabis stock prices are just as irrational as everything else in this industry. None of this is investing advice, of course, but investors in this space need to recognize and embrace the meshuggeneh if they’re going to wade in.

Be seeing you!

© 2024 Marc Hauser. None of the foregoing is legal, investment, or any other sort of advice, and it may not be relied upon in any manner, shape, or form. The foregoing represents my own views and not those of Jardín.

I am actually relieved that scheduling isn't being used as a political device before the election. Having read the 252 pages from HHS, and the OLC memo responding to the DEA objections to the HHS recommendation, I'm convinced this isn't a political stunt. It's controversial, for sure, and DEA should hold hearings on it to air out all the various positions and resolve any misconceptions. I would have to guess investors were thinking it was a political tool that would be rammed through without any due process.