Friends – the Internal Revenue Service issued something of a smackdown last week that’s a good reminder to be skeptical of everything in this industry.

We’ve talked a few times about cannabis operators filing for refunds for prior 280E tax payments. Trulieve took the lead, and others followed, basically placing a bet - obtain the refund and hope the IRS doesn’t challenge it; however, if the IRS does challenge it through audit (a real contingency these companies provide for on their financial statements) and wins, then pay back the refund with interest. That rate of interest is almost certainly going to be less than what a lender is going to charge a cannabis operator, so it ends up being pretty good financing mechanism for a couple of years while the audit plays out.

The one weird trick is avoiding a penalty for failure to pay taxes. That’s where the law firm comes in – each of these companies filing for a refund presumably got an opinion from a law firm saying that the basis for the refund has a certain level of soundness in tax law. I’m generalizing here, but the basic idea is that, if your third-party tax advisor said that your filing wasn’t totally bonkers (not an actual legal standard), you should be able to avoid a penalty, which gets really expensive.

The tactic, in my experience, was misunderstood by much of the industry and the investing public. It’s not as much of a slam-dunk as some wanted it to be (so much hope in this industry). The cost of obtaining the legal opinion and defending the audit isn’t cheap, so it really only makes sense for larger companies (and companies with less than $25mm of revenues usually look to 471(c) to mitigate 280E anyway). And even if it’s cheap-ish financing, it’s really hard to weigh the risk of losing the audit fight (and it’s not like Tax Courts have been sympathetic to 280E arguments in the past).

Needless to say, I’ve been skeptical about the approach, although I’m impressed with the sheer chutzpah of it. It’s another good example of professionals finding novel ways to work within the system to help make this industry be less painful.

Late last week, the IRS let us know that it’s paying attention:

Although the law has not changed, some taxpayers are filing amended returns. The grounds for filing such claims vary, but these claims are not valid. The IRS is taking steps to address these claims.

Mildly menacing, no? I particularly love the use of the word “address” – it’s the kind of thing a high school principal would say when faced with some unruly hijinks. But the IRS doesn’t mince words when it says “these claims are not valid.” It doesn’t give a reason, but then again, it doesn’t really need to in a press release.

On May 21, 2024, the Justice Department published a notice of proposed rulemaking with the Federal Register to initiate a formal rulemaking process to consider rescheduling marijuana under the Controlled Substances Act. Until a final rule is published, marijuana remains a Schedule I controlled substance and is subject to the limitations of Internal Revenue Code Section 280E.

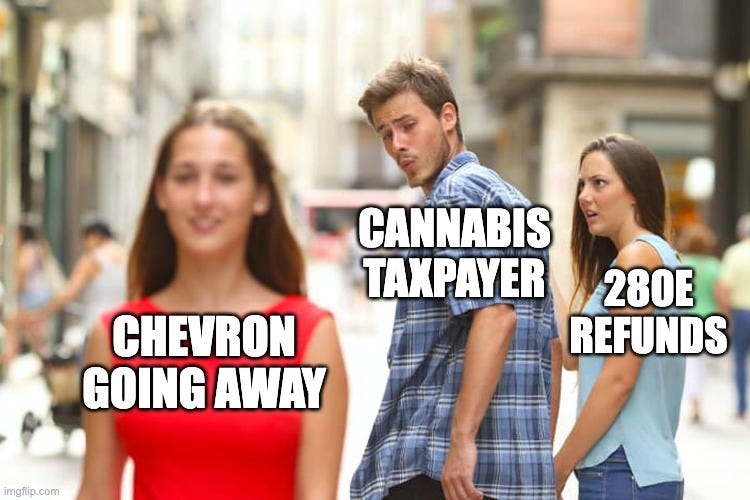

Does this mean that the refunds would be valid if cannabis were indeed rescheduled (i.e., retroactivity)? Why even bother to mention rescheduling that’s not the case? It's all a little cryptic, but that’s par for the course with the IRS. I wouldn’t try to read too much into this until we see how they officially react, but this is definitely a shot across the bow. There’s no easy money in this industry, no matter how creative the argument.

With that in mind, you may now be thinking, hey, I just read about how the US Supreme Court got rid of the Chevron doctrine, so why not instead sue the IRS over 280E based on that? Well, Cannabis Musings anticipated your flight of fancy over a year ago. As much as I think you shouldn’t try to play amateur tax lawyer (unless you actually are a tax lawyer) to try to understand the chances of success of the 280E refund structures, you definitely shouldn’t try to play amateur administrative law lawyer (again, unless that’s your actual job).

Chevron said that courts would generally defer to regulatory agencies interpreting ambiguous laws. The Court’s decision doesn’t mean that the IRS now can’t enforce anything. Plus, recall that 280E is a matter of statute (law) itself, passed by Congress due to a fact pattern straight out of the most boring episode of Miami Vice ever. I’m all for creative lawyers storming the castle, but don’t just assume that no Chevron means everything is up for grabs. Mit shnai ken men nit machen gomolkes (“You can’t make cheesecakes out of snow.”)

Be seeing you!

© 2024 Marc Hauser and Hauser Advisory. None of the foregoing is legal, investment, or any other sort of advice, and it may not be relied upon in any manner, shape, or form. The foregoing represents my own views and not those of Jardín.