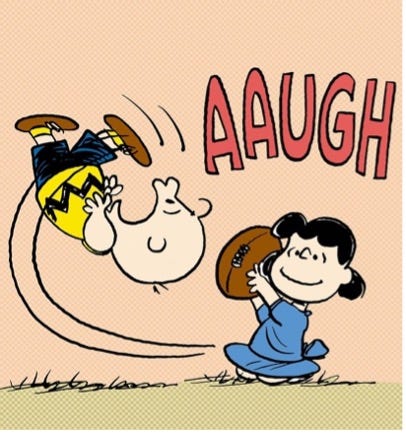

Friends, I really don’t like talking about the SAFE Banking Act. I mean, yeah, we’ve talked about it plenty over the past year, and indeed it’s been a topic of these Cannabis Musings for years, viewed through our lens as, well:

But that doesn’t mean I like the topic.

Why? Because there’s honestly not really that much to say about a draft law that’s been proposed nine times over the better part of a decade and still can’t seem to get passed. Admittedly, I like correcting people when I explain they’re wrong about what they think SAFE would do (like exchange uplisting or credit cards – nope), but that’s just a sugar rush.

SAFE remains the (again, metaphorical) raspberry seed in my wisdom tooth. So, it was with annoyance that I read that Congress is now taking up SAFE again, but this time, they’ve named it the “SAFER Banking Act”. That’s right – they changed the acronym to include an “R” for “Regulation” (maybe because they wanted to reset the counter back from 9 times to 1?). If this version doesn’t work, I’m really hoping the next one is named the “SAFERER Banking Act.”

As you’ve likely read, the text of SAFER is pretty much the same as SAFE as far as the cannabis industry and operators are concerned – the differences mostly address concerns relating to back-end bank regulations and reporting. No, it still doesn’t do anything about investment banks, or stock exchanges, or credit card merchants, or equity custodians, or non-bank lenders, or investors, or non-bank banks, or, well, you get the point. The kind-of-curious protection for ancillary businesses from money laundering charges is still there in Section 4, and I’m still confused why more attention isn’t paid to that section.

Will SAFER pass? Come on, you should know better than to ask me that question.

What’s really interesting to me is to observe the disconnect between how certain corners of the industry are so deeply focused on SAFE(R)’s passage, while, at least from my perspective, the vast majority of the industry responds with a tired “Nu? Vos macht dos oys?” (“So? What difference does it make?”) .

If you were following #cannabis X (f/k/a Twitter) on Wednesday morning, you would have noticed an unusual amount of enthusiasm for a House Oversight and Accountability Committee hearing about the Cannabis Users’ Restoration of Eligibility Act, which addressees security clearances for cannabis users (it passed the Committee on a bipartisan vote). The excitement was palpable as investors looked for any hints as to how Committee members might possibly vote on SAFER, because that law, in their calculus, would be the catalyst to cause cannabis stock prices to soar (which may be correct!).

On the other hand, you’ve got much of the industry not giving it much attention (beyond the appropriate and excellent journalistic coverage of the topic out there). I think they share my same exhaustion with the topic, and also appreciate that banking services are much more widely-available to the industry than when SAFE was first introduced, meaning the bill isn’t as critical as it once was (although not to downplay that it might indeed bring down the cost of banking and insurance services, which would be nice, as would a bump in stock prices), while the immediate economic benefits (removing 280E applicability) from a Schedule III rescheduling of cannabis are more exciting and tangible.

Maybe it’s just me, but it seems like the industry’s expectations of the federal government have been (appropriately) tempered over the years. During the heady days of 2017-19, when the state-legal industry was riding high on a wave of cheap money and boundless exuberance, it was hard to find many people as pessimistic about federal cannabis policy as myself. Few wanted to hear my skunk-at-the-picnic reminder that the entire business exists at the whim and grace of the Department of Justice. Today, remarkable news like the HHS rescheduling recommendation is met with faint hope swathed in a deep layer of trepidation and skepticism. And for good reason.

That’s not to downplay the incredible amount of federal policy progress that’s been made by the industry recently, in no small part due to the very hard work of many industry insiders behind the scenes (for which we should all be grateful) who don’t promote their every action on social media. There’s plenty of ways to go, but the conversation is changing and the industry is finally starting to drive the narrative.

Be seeing you!

Hauser Advisory provides advice and strategy on business lifecycle events and cannabis industry navigation, tapping into a deep, national network and twenty-five years of dealmaking and capital markets experience.

© 2023 Marc Hauser and Hauser Advisory. None of the foregoing is legal, investment, or any other sort of advice, and it may not be relied upon in any manner, shape, or form.